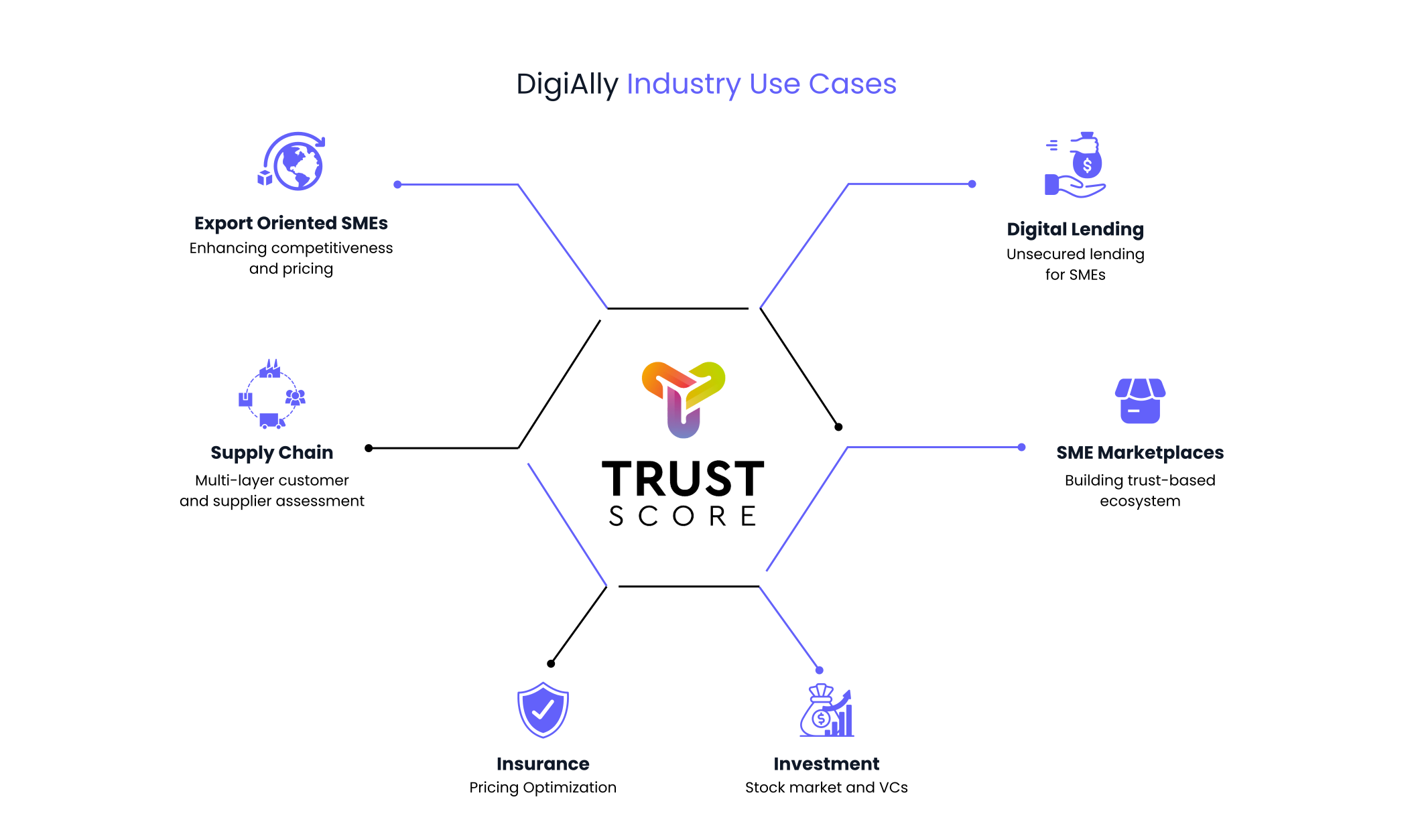

Our Platform

Trust Based Embedded Finance Platform

Through SME due diligence, SME rating and continuous portfolio monitoring, we establish the intent, potential of SMEs to pay back the raised capital, and we do that by analyzing an 150+ data points (financial, non-financial and business model data points) to create an trust score for SME using AI driven realtime predictive modelling. Our deep learning model grades SMEs into 4 categories Bronze (eligible to lend) to Platinum (high performance and reliable) based on our own trust score for SMEs.

SMEs, banks and financial institutions can easily access comprehensive reports of portfolio assessments, accompanied by an AI-powered trust score. This streamlined process enables swift loan processing and empowers informed decisions for company improvement and growth. On the flip side, banks and financial institutions gain the ability to expand their SME loan portfolios by connecting with curated SME customers through our platform.

API integration with marketplaces, digital partners

With DigiAlly trust score integration, our partner platform enables a smooth journey to their customers (SMEs) seeking capital for business expansion. This allows easy onboarding and matching of SME with partner ecosystem. We enable this journey across the lifecycle of SME customers, including lead management, credit assessment, portfolio management and collections. With the integration of our platform, our partners can offer differentiated services to SMEs based on their grading.